What Factors Make Up Your Credit Score—and How to Improve It

If you’re preparing to buy a home, your credit score plays a major role in what kind of mortgage you’ll qualify for—and at what rate. But many people don’t fully understand what affects their credit score or how to improve it.

At Origen Realty, we work with buyers every day who are navigating the home loan process, so let’s break it down in simple terms: what goes into your credit score, why it matters, and some smart ways to raise it.

What Is a Credit Score?

A credit score is a number (usually between 300–850) that lenders use to determine how risky you are as a borrower. The higher your score, the more likely you are to qualify for a loan with a lower interest rate—which can save you tens of thousands over the life of your mortgage.

Your score is calculated by the three major credit bureaus—Experian, TransUnion, and Equifax—using information in your credit reports.

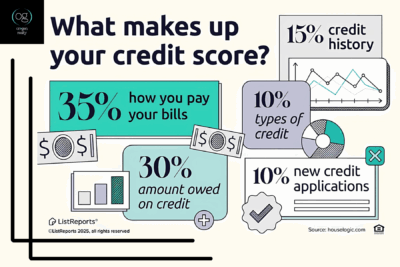

The 5 Key Factors That Make Up Your Credit Score

Here’s what goes into that magic number:

-

Payment History (35%)

Your history of making on-time payments is the single biggest factor. Late payments, defaults, and collections all hurt your score.

Pro Tip: Set up automatic payments or calendar reminders to stay on track. Even one late payment can have a long-term impact.

-

Credit Utilization (30%)

This is the ratio of how much credit you’re using compared to how much you have available. Ideally, you want to stay under 30% of your total credit limit.

Example: If you have a credit limit of $10,000 across all cards, try to keep your total balance under $3,000.

Pro Tip: Make mid-month payments to reduce your balance before it reports to the credit bureaus.

-

Length of Credit History (15%)

The longer your accounts have been open and in good standing, the better.

Pro Tip: Avoid closing old credit cards, even if you don’t use them often—especially if they have no annual fee. They help lengthen your average account age.

-

Credit Mix (10%)

Lenders like to see that you can manage a variety of accounts—credit cards, car loans, student loans, etc.

Pro Tip: You don’t need one of everything, but responsibly managing both revolving credit (like credit cards) and installment loans (like auto or mortgage loans) can help your score.

-

New Credit Inquiries (10%)

Each time you apply for credit, a “hard inquiry” is added to your report. Too many in a short time can drop your score.

Pro Tip: If you’re rate-shopping for a mortgage or auto loan, try to submit all applications within a 14–45 day window. These are often treated as a single inquiry.

How to Improve Your Credit Score Fast

If your credit score isn’t where you want it to be, don’t panic. Here are some fast-track tips to start boosting it:

- Pay down high credit card balances. Lowering your utilization can show results in as little as 30 days.

- Dispute any errors on your credit report. You can request a free copy annually at AnnualCreditReport.com and challenge any mistakes.

- Become an authorized user. A trusted family member can add you to their long-standing, well-managed credit card account.

- Ask for a credit limit increase. This can instantly improve your utilization ratio—as long as you don’t increase your spending.

Why Your Credit Score Matters When Buying a Home

Your credit score doesn’t just determine whether you qualify for a mortgage—it affects your interest rate, loan program eligibility, and even how much you’ll pay in monthly mortgage insurance.

For example, a buyer with a 760 credit score could qualify for a lower rate than someone with a 640 score, potentially saving hundreds per month on their mortgage payment.

Ready to Take the Next Step?

If you’re thinking about buying a home but aren’t sure how your credit score will impact your options, we’re here to help. At Origen Realty, we can connect you with trusted lenders who will walk you through the process—and help you make smart financial decisions every step of the way.

Let’s make sure your credit score is working for you, not against you.

👉 Have questions about financing, credit scores, or home buying in Texas? Contact us today!